A proposed climate disclosure rule in the U.S. brings the country in line with other regulators in Europe that have proposed more stringent corporate disclosure of greenhouse gases. While the proposal isn’t final, companies should begin preparing now.

The lack of standardized disclosure requirements on climate risk and emissions has created reporting challenges for companies as investors demand more climate oversight. The United States (U.S.) Securities and Exchange Commission (SEC) now joins two other major global players to bring consistency and comparability to environmental disclosures, as discussed in Aon’s alerts on the European Union’s Corporate Sustainability Reporting Directive and the International Sustainability Standards Board.

On March 21, 2022, the SEC proposed rules that would require publicly traded companies listed in the U.S. to include climate-related disclosures in registration statements, annual reports, and Form 10-K filings. The proposed rules would require significantly increased disclosure on material climate risks, management systems and emission metrics from companies under the SEC’s oversight.

The proposed rules will be subject to a public comment period after they are published in the Federal Register.

Why the SEC is Proposing Climate Rules

As stated by the SEC and articulated by several prominent investors’ guidelines, shareholders are increasingly concerned about the ramifications of climate change on investments. As a result, investors demand companies disclose more information about the impact of climate change on their operations and strategy and their level of oversight to manage and address climate risks.

SEC Chairman Gary Gensler relayed in his statement on the proposed climate rules that he is guided by the concept of materiality related to investor decision-making. Gensler cited the Supreme Court ruling Basic Inc. v. Levinson to underpin his position that information is material if “there is a substantial likelihood that a reasonable shareholder would consider it important” in making an investment or voting decision or if it would have “significantly altered the total mix of information made available.”

The SEC maintains that current company disclosures use inconsistent reporting standards and thus are challenging to compare. Many companies have echoed this challenge in reporting climate risk and emissions, while investors and other stakeholders say it’s difficult to interpret consistent climate metrics across industries. In his statement, Gensler notes the rule would “provide investors with consistent, comparable and decision-useful information for making their investment decisions and would provide consistent and clear reporting obligations for issuers.”

Standardized reporting and data would likely be more integrated into the decision-making processes at large investment firms if the rule goes into effect.

Building on Current Climate Reporting Frameworks

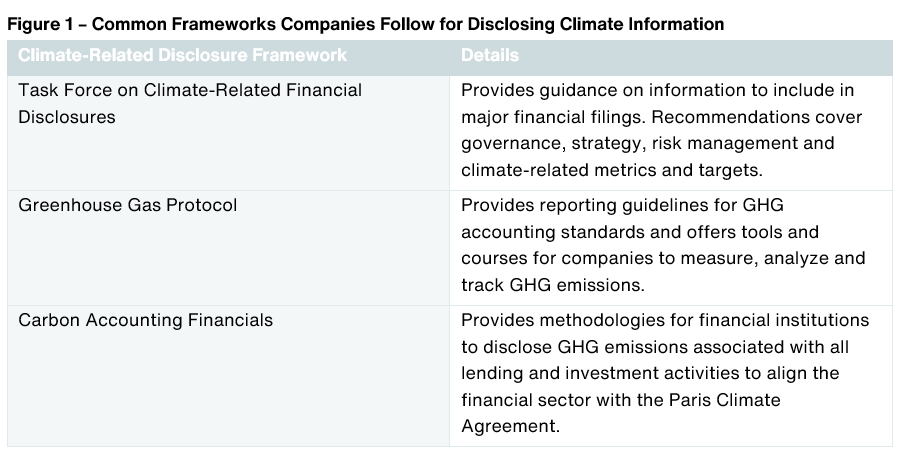

The climate disclosure requirements proposed in the new rule are based on existing, widely accepted disclosure frameworks like the Task Force on Climate-Related Financial Disclosures (TCFD), the Greenhouse Gas Protocol and the Partnership for Carbon Accounting Financials (PCAF). The SEC says it considered these three reporting regimes when developing disclosure requirements.

Many large-cap, publicly traded companies currently report on climate data and governance based on the following frameworks in Figure 1. If the proposed rules move forward, companies will lean even more heavily on these frameworks. In doing so, issuers will need to accurately interpret and report in alignment with these frameworks.

Opposition to the Proposed Rule

The proposed climate rule is likely to face court challenges and require significant compliance costs and efforts for issuers. Additionally, there is a concern that the proposed rules are outside of the SEC’s regulatory authority. Republican SEC Commissioner Hester Peirce released a statement against the proposed rule, saying the climate disclosures would “be mandatory for all companies without regard to materiality.”

Business trade associations have already indicated their opposition to the expansive nature of the proposed rules. For example, the U.S. Chamber of Commerce said in a statement that “the prescriptive approach taken by the SEC will limit companies’ ability to provide information that shareholders and stakeholders find meaningful, while at the same time requiring that companies provide information in securities filings that are not material to investors.”

Regardless of whether the proposed rules are modified and eventually approved, it is clear that companies should evaluate and enhance climate disclosures to meet growing expectations from investors, regulators, customers, employees and other stakeholders.

What Does the Proposed Rule Require?

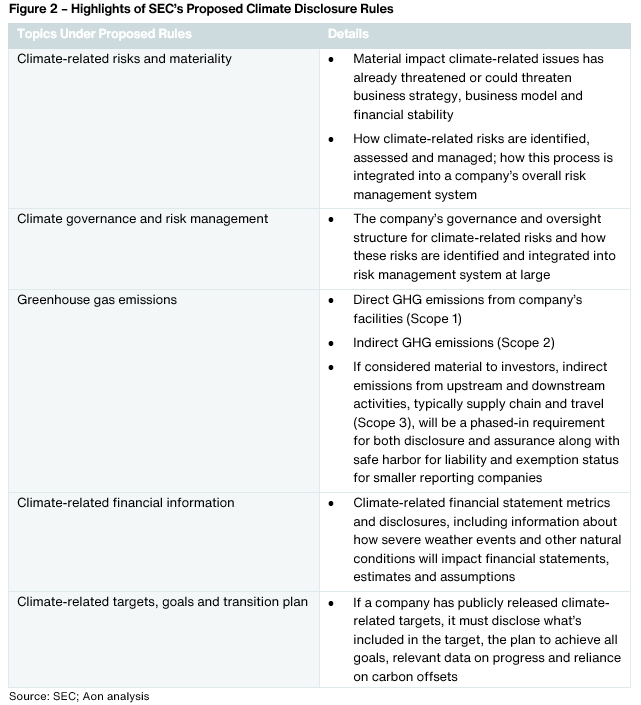

The proposed rule aims to standardize climate reporting across all companies and industries. The aim is to standardize reporting and stay focused on the SEC’s existing definition of financial materiality. The rule doesn’t attempt to wade into double or dynamic materiality of other ESG disclosure frameworks, unlike the Corporate Sustainability Reporting Directive (CSRD) in the European Union, which is expected to be implemented in January 2023. In general, the proposal would require registrants to report on the following:

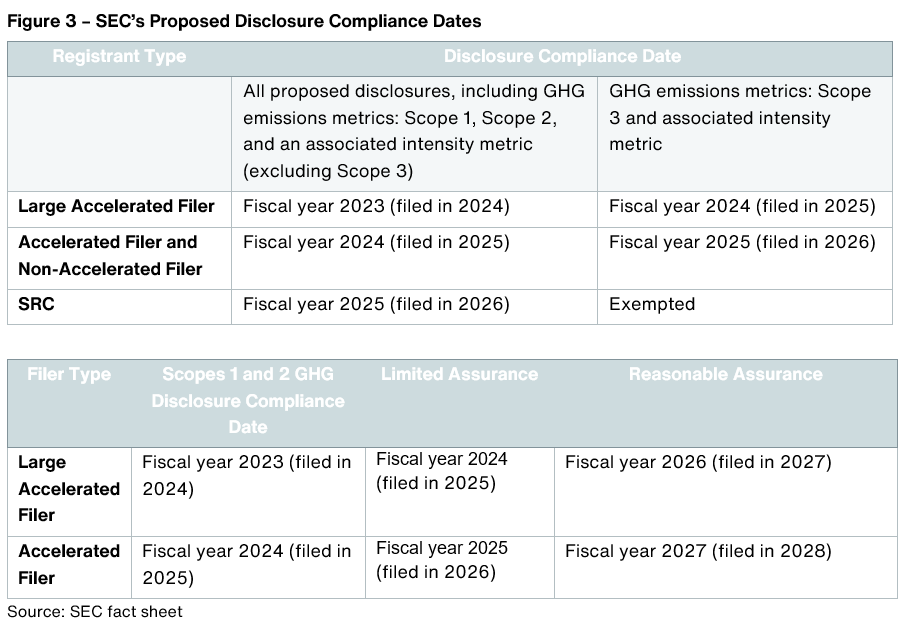

If the climate rule is approved in 2022, these new requirements will be phased in over the course of the next few years, with the earliest compliance date for portions of the rule established for large public companies’ filings in 2024 for their fiscal year 2023 reporting.

The SEC’s fact sheet on the climate rule outlines the timing and phased-in schedule for elements of the disclosure requirements. This schedule assumes the proposed rules will be adopted and effective as of December 2022 and the filer has a fiscal year-end December 31 timeline.

How Aon Can Help

Hundreds of public companies track and report climate-related risks. Over 80 percent of S&P 500 companies already disclose some data around greenhouse gas emissions, according to the Center for Climate and Energy Solutions. Climate governance and reporting is top of mind for many investors. However, there is no standardized reporting method to ensure comparability. For our clients, managing climate governance and risk, as well as tracking and reporting greenhouse gas emissions, is consistently one of the most challenging issues.

Aon’s team of governance and ESG experts offers advisory services on climate reporting and governance. Our team guides companies on upcoming climate regulations, provides TCFD reporting and reviewing support, and engages boards and management to provide education and strengthen climate risk acumen and oversight. For more information on how we can help, please write to humancapital@aon.com.