Sales professionals in the technology sector are capitalizing on an improved job market. Voluntary turnover is at five-year high, forcing sales and human resources leaders to assess whether their current compensation plans remain effective in an increasingly competitive market for talent. Clearly, companies must now work harder to retain sales reps if they want to avoid the high cost of replacing them.

In the fourth quarter of 2014, median voluntary turnover for US sales professionals in the technology sector was 11.2%. This means that slightly more than 1 in 10 sales reps in good standing decided to leave their company in the past 12 months (October 1, 2013, to October 1, 2014, in this case). Turnover rates are even higher in the booming software industry, as "hot" new companies continue to prolifierate. During the same period mentioned above, median voluntary sales turnover at software firms was 13.3%.

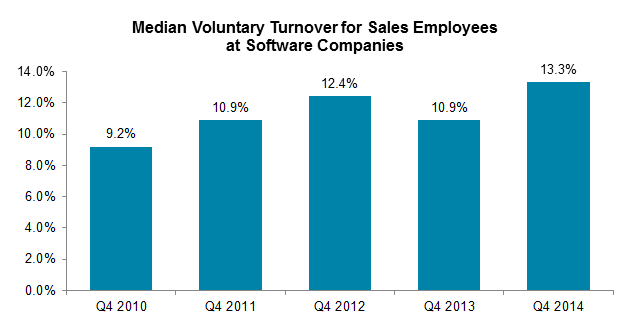

To put this data into perspective, the following chart illustrates median voluntary turnover rates for US sales employees at software companies across Radford's last five Q4 Workforce Trends Reports. As the chart shows, turnover is trending upward as the economy recovers and technology profits accelerate.

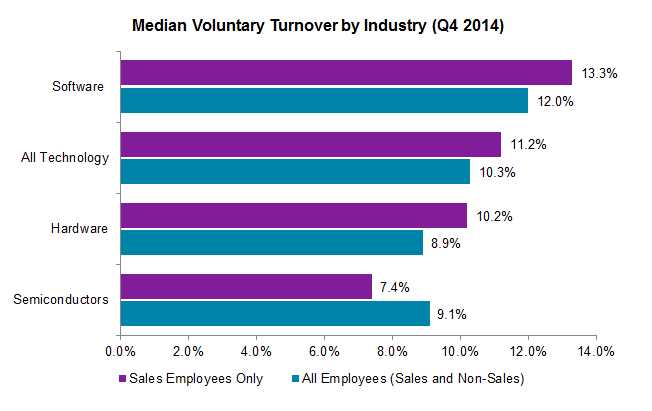

Of course, it's of little surprise that voluntary turnover is increasing as macro-economic indicators improve. As more jobs are created in the US economy, people have more opportunities to switch companies. With that in mind, we took the additional step of looking at sales vs. overall employee turnover across several industries to isolate the biggest pockets of turnover. When looking at the data in this fashion, the rate of voluntary turnover for sales professionals at software companies stands out.

In the fourth quarter of 2014, across all slices of our data, sales professionals at software companies led the pack in terms of voluntary turnover. A rising tide is lifting all boats, but as the chart below illustrates, other forces appear to be at play when it comes to attracting and retaining sales talent at software firms.

Beyond the macro-economy, what's driving accelerated voluntary turnover among sales professionals at software companies? There are several likely culprits. First, the competition for talent among established technology players looking for sales reps with cloud experience is fervent. Next, sales reps in the software space are often motivated by selling innovative or unique products and services. Once a company's pipeline for new products dries up, becomes stale, or faces increased competition, sales professionals can grow frustrated in their jobs. This frustration quickly translates into turnover as soon as ample job openings become available.

From our vantage point, we don't expect the pace of turnover to slow down anytime soon. For the broader technology sector, 16.9% of companies indicate they are hiring aggressively in the US this year. That's the highest rate among all 23 countries where Radford currently tracks expected hiring.

Next Steps

Companies need to be aware that they are increasingly at risk of losing key sales talent if they do not take proactive measureses to keep sales staff engaged. This includes ensuring that complex sales compensation plans are properly designed to motivate employees and reward for high performance. If a company is losing critical sales talent in mass, there are steps it should take to assess the source of the turnover. These steps include:

- Conducting comprehensive exit interviews to uncover aspects of the sales job—including incentive compensation design—that may be causing a disconnect with employees;

- Evaluating the company's hiring practices to see if it is attracting high performers that fit within the company's culture; and

- Investing in quality new-hire training programs and ongoing developmental training.

Once the source(s) of the problem are identified, sales leadership, in partnership with human resources and compensation managers, can work on solutions. However, managers should not be surprised by some level of elevated turnover among their sales staff given the current economic landscape and rates of product innovation.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to [email protected].

Related Articles