As economic growth in Brazil continues to slow, fewer technology workers are leaving their jobs relative to other major markets in the region, such as Argentina and Mexico.

Employee turnover is more than just a number. It is the end product of a wide range of variables, including employee engagement, job satisfaction, company performance, and macro-economic trends. This makes studying employee turnover fascinating, especially in troubled markets like Brazil.

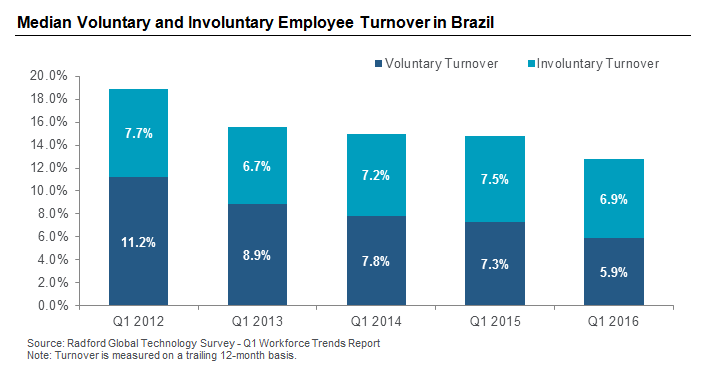

Having sustained negative GDP growth for two consecutive years, Brazil is struggling to regain its status as a leader among emerging growth economies. The rapid slowdown experienced in Brazil has quickly forced workers to think long and hard before leaving their jobs, even for opportunities that might appear to be better, and greatly reduced the availability of new job openings as hiring declines. As the chart below illustrates, the impact on overall employee turnover (i.e., the sum of voluntary and involuntary departures) has been dramatic in Brazil.

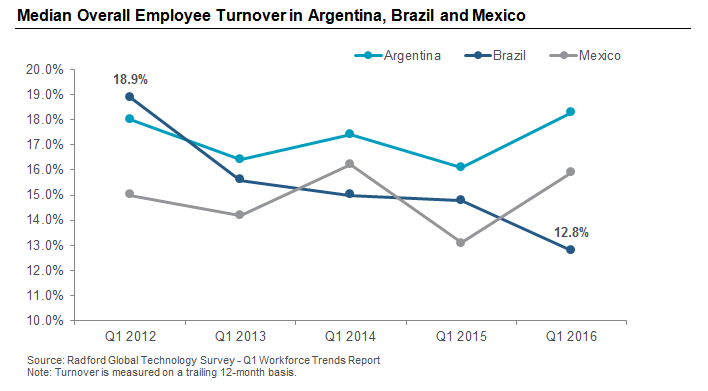

To place the latest employee turnover data from Brazil into further context, we used additional data from the Radford Global Technology Survey to look at turnover rates in Argentina and Mexico.

Over the past four years, overall turnover in Brazil has slowed from 18.9% in Q1 2012 to just 12.8% in Q1 2016. During that same period, overall turnover in Argentina has increased slightly from 18.0% to 18.3%. The same is true in Mexico, where overall turnover climbed from 15.0% to 15.9% over the same four-year period.

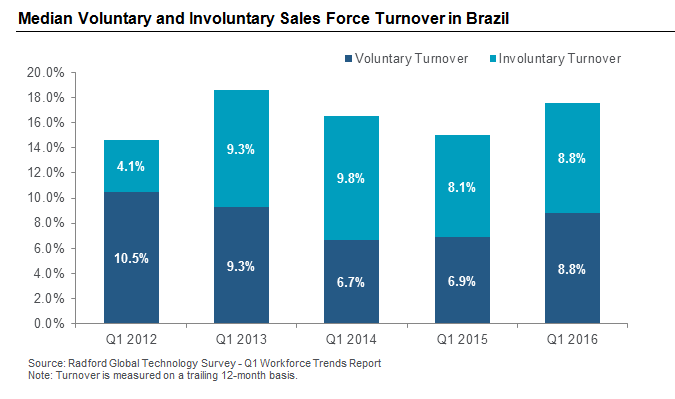

However, employee turnover among sales employees in these three key Latin American markets looks a little different. Sales employees are included in the overall population in the charts above, but if we look at only sales employees there hasn’t been as dramatic of a four-year decline.

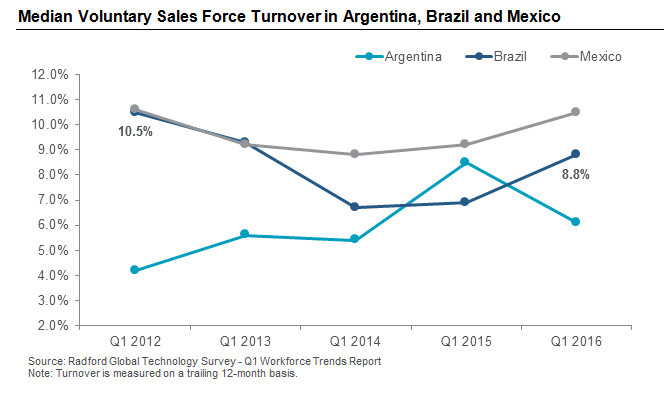

Voluntary turnover among sales employees in the Brazilian technology sector had been trending downward until the past year when it picked back up. From Q1 2012 to Q1 2015, voluntary turnover among sales reps in Brazil fell from 14.6% to 6.9%, while overall turnover remained steady. Overall and voluntary turnover has increased in the past year. By comparison, voluntary turnover has taken a steep drop among sales reps in Argentina and has been more flat in Mexico. This data could be interpreted as good news for Brazil. The first sign of growth within a market often involves hiring more sales employees. The rise in voluntary turnover among sales reps in Brazil over the trailing 12 months ending in Q2 2016 could be an indicator that companies are responding to rising demand.

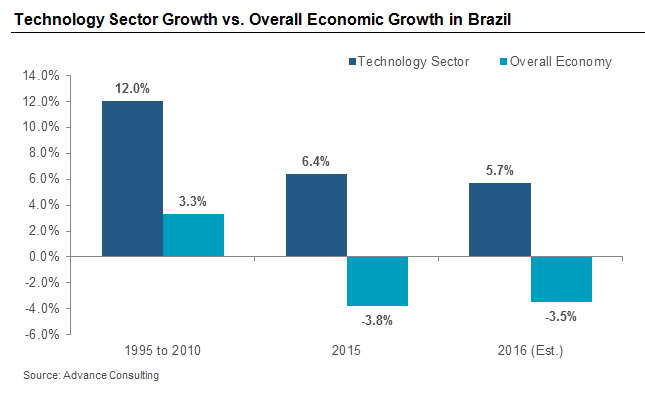

While technology sector employees in non-sales roles clearly feel their job opportunities are more limited in Brazil compared to neighboring countries, the IT industry remains a bright spot in the country’s overall economy. The sector is forecasted to grow 5.7% in 2016, according to a study by Advance Consulting, a local performance management firm specializing in IT and telecom companies. Although that’s smaller than historical growth for the technology market in the country, it represents notable expansion for an economy that is experiencing extended contraction in GDP.

There are tremendous growth opportunities for technology companies in Brazil that want to take advantage of the large digital market. Roughly half of the country’s population is online, making it the fifth largest internet and mobile economy in the world with ample room for continued expansion. Brazil is also one of the fastest-growing mobile phone markets. Earlier this year, the Brazilian government launched an incentive plan called “TI Maior” that aims to double the annual income coming from the technology sector in the country through investing R$486 million in the startup and software markets.

Furthermore, the startup environment in Brazil is soon expected to account for 5% of total GDP in the country. There were more than 4,000 early-stage companies in the country at the end of last year, which represents an 18.5% increase over the prior six months, according ABStartups, an association of Brazilian startup companies. The bulk of these startups are in the FinTech and software as a service (SaaS) subsectors. SaaS companies have focused on applications for health and education companies, which provide a steady source of demand.

While there is plenty of negative economic and political news coming out of Brazil, entrepreneurs and investors have a lot of reasons to be hopeful about the future of the technology sector in the country. The robust startup scene driven by innovative software and SaaS companies are attracting local and international investment from venture capital and private equity firms. That, combined with the amount of growth opportunity driving demand within the country, makes us optimistic about the future for technology companies and workers in Brazil.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to [email protected].

Related Articles