During an economic downturn, sales leaders should place their energy into three critical focus areas to limit business erosion and support the development of long-term growth strategies.

While the scope and impact of the COVID-19 pandemic is unprecedented in modern times, the economic retrenchment it has triggered, along with the dawn of a new economic cycle, is not. And when it comes to economic cycles, it’s not just a matter of market highs and lows. Every new cycle lays the groundwork for new waves of companies, and even new industries, to emerge as drivers of economic growth. Historically, when companies successfully navigate economic challenges it is because they use downturns as an opportunity to gain clarity on sales force priorities, including re-examining target markets and customers, sales coverage models, talent requirements and sales capacity.

For sales organizations, there is no doubt severe headwinds exist today. Pressure to discount products and services will increase, the prospect of hitting annual sales targets seems daunting for many, pipelines may dwindle and competitive forces will be pervasive. And that’s just the revenue side of the equation. Many companies will also downsize their workforces. While sales teams are usually not the first functional area to cut employee costs, sales leaders will be under pressure from their CFOs to reduce expenses. Variable controllable costs, such as travel and entertainment budgets, simply do not offer sufficient reductions. The question then becomes, how can sales functions best respond if sales growth and business retention are the surest path to shareholder returns?

While there are several tactical, short-term sales compensation and quota-setting actions that companies can consider to retain their sales team, the reality is that businesses need to prepare for a longer, lower growth business climate. During Q1, the U.S. economy shrank at its fastest pace since the last recession as a result of the COVID-19 pandemic shut-down, signalling the end of the longest economic expansion on record. These numbers point towards the inevitability of recession. Whether one plays out in full, or current events simply temper business conditions to usher in a period of stagnation, it’s now more important than ever to remain proactive by resetting sales priorities, adjusting sales force deployment and refocusing sales force efforts – all of which can pay significant growth dividends down the road.

This article discusses three primary planning areas that can better calibrate the sales force to survive pending business conditions and be better positioned for future growth opportunities. If sales leaders are able to persevere with sales forces with a higher level of “recession-proofing,” they should be better aligned to focus on what they do best: selling and generating profitable revenue.

Focus Area 1: Preserving and Growing Your Base

Companies value new logos given that, over time, these additional accounts increase market share and provide a foundation for the expansion of sales opportunities to known entities. However, the temptation to chase growth through new accounts should be put into context. Prioritizing new account acquisitions while diverting attention away from your existing account base can be perilous. It’s a simple case of scale, as new accounts usually don’t “move the needle” in the top line performance picture nearly as much as growth from the existing base.

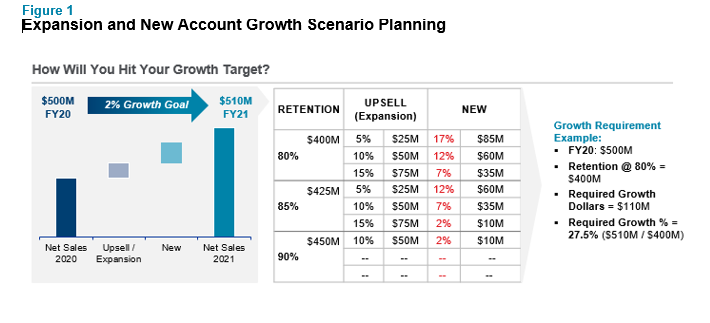

Growth planning is not necessarily about finding the single best path to forward; it’s about playing out scenarios based on sources of growth and areas of risk, while assessing potential paths to stress test in terms of capability, capacity and historical trends. Scenario planning is a sobering exercise that illuminates just how challenging meeting even modest growth goals can be if existing accounts pull back and spend less than prior years.

As an example, even with a small 2% annual sales growth goal, and assuming existing contracting accounts spend 80% compared to the prior year, a sales leader would need to find 27.5% growth through a combination of new logo and existing account expansion sales (see Figure 1). What presented itself as an achievable goal is made exponentially more challenging due to the deterioration of the base business. In times of recession or stagnation, this is a likely scenario.

Focus Area 2: Sales Coverage

The old adage is true that it costs a lot less to retain customers than it costs to acquire new ones. Not only does replacement selling pull resources away from incremental growth, but new customer revenue costs more (in our experience, typically three to five times the cost of retaining current customer revenue). However, should all customers be treated equally? The short answer is no.

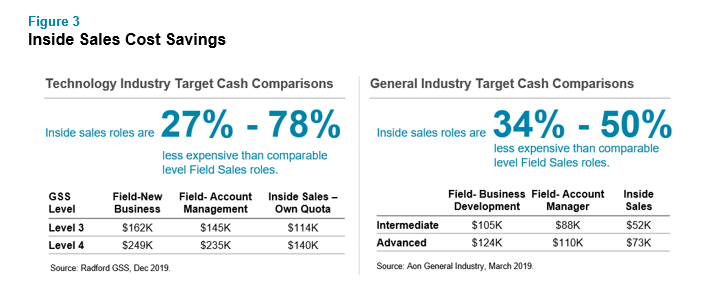

For a better handle on the customer base to help reassess the best fit sales coverage model, companies can execute a handful of key analyses to address critical coverage questions and prioritize resources accordingly as shown in the table below.

Since a disproportionate amount of revenue usually comes from a limited set of customers, companies should target high-value clients with critical sales resources that have the talent to retain and grow business with the current customer base. The key is knowing which customers represent the highest value to your organization. While segmenting customers by revenue is helpful, it excludes critical insights into associated service costs.

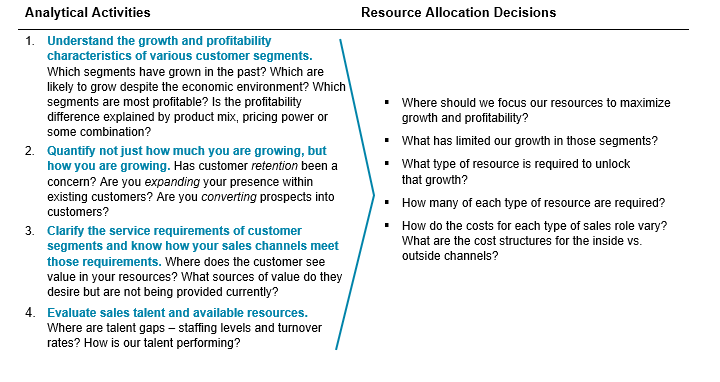

Indeed, some more advanced companies take the next step of segmenting customers according to profitability. A current view of customer profitability is essential to decide how to allocate resources effectively. Customers who deserve resources or have high potential for growth justify the resource allocation. That said, lower-value customers should be transitioned into lower-cost channels to reduce the operating expense associated with them. Further, simply limiting coverage for non-strategic and underperforming market segments is a viable option to help focus on positions of strength. Business-to-business companies are rapidly increasing their usage of inside sales channels irrespective of the business climate (see Figure 2 below for select industry examples for inside sales adoption trends).

To put this into perspective using the technology industry as an example, in 2010 there was one inside salesperson for approximately every 21 field salespeople. That ratio decreased dramatically by 2019 to one inside salesperson per every 3 field salespeople. Figure 2 also shows that, while field sales headcount as a percentage of total sales function has remained relatively consistent, inside sales roles have increased in the past decade.

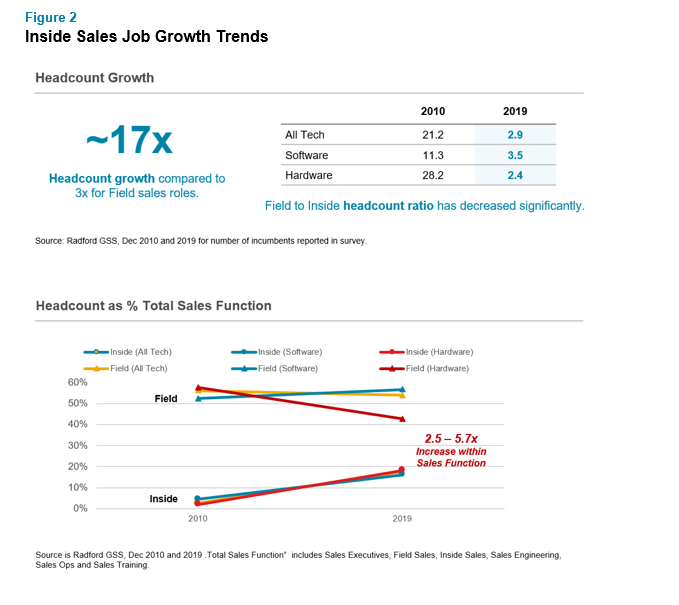

Customers are more content-driven and tech savvy with increased usage of digital channels and, when asked the right questions to determine true preferences, findings often reveal the inside channel as a strong coverage fit. The benefits of the inside sales channel are numerous: 1.) ease to scale headcount; 2.) increased selling and service time with customers; 3.) less expensive resource (See potential cost savings in Figure 3); and 4.) sharing of best practices in group settings and consistent up-skilling of sales tactics. Moreover, inside sales is not just a small-to-medium business play. After conducting segmentation and analysis, several of our clients are surprised that the inside sales channel sells to, services and grows some of their largest and most valuable accounts.

Focus Area 3: Right-Size the Organization

Few examples exist of layoffs yielding long-term gains for shareholders. Alan Blinder, the former Federal Reserve vice chairman, says there is little evidence that downsizing boosts productivity. In many cases, cost cutting actually hurts more than it helps [1]. This is particularly true when the cost cutting occurs within sales organizations. That said, reducing headcount is an undesirable, but sometimes necessary, exercise. In previous recessions, the conventional wisdom was guided by cost-cutting mandates, such as reducing a percentage of the sales force in an across-the-board cut. The problem with this approach was that it valued all areas equally within the sales function.

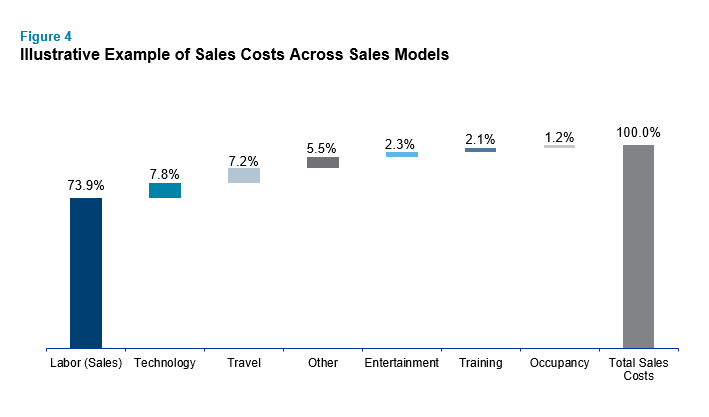

Given that sales costs represent a significant portion of overall costs and that sales team salaries and incentives are generally well over 50% of sales costs across sales models (see Figure 4), cost cutting pressure will continue. Laying-off new hires and low performing sales reps can help. However, this low-hanging fruit is also reactionary and may not be sufficient. In our view, poor market conditions can be an opportunity to make adjustments more intelligently and with a holistic perspective. Right-sizing the sales force for the longer-term should be the true aim for sales leaders.

So, how is this sizing exercise done and why is it challenging? Let’s put customer relationship disruption considerations to the side and focus on sales workforce composition. The reality with sales organizations is that not all roles are the same or cost the same. Different roles focus on different products, market segments and/or phases in the sales process and account lifecycle. How you structure the composition of the sales force can not only reduce costs while maintaining overall headcount, but it can also better align to the needs and preferences of your customers.

Building on the answers to the key sales coverage analyses outlined earlier, the first decision point is what portion of the business should be covered by the inside vs. outside sales channel. This distinction will provide an approximation of sales volume for each channel and will serve as the basis to size the organization by role. The process involves defining clear territory types that align to the role, analyzing the aggregate account and sales volume by territory type, and then estimating an initial number for each territory type.

Finally, you will need to build the actual territories. There are different approaches to do this, but the more analytical avenue assigns each account a value for attributes, such as current spend, sales potential and workload (i.e., time to sell and serve). As territories are built as a group of accounts to a target value range for specific territory types, additional inputs (e.g., driving distance for field territory reps) are added to refine the analysis. The process is iterative, as sales management provides feedback and applies good business judgment where needed.

Conclusion

The tumult of global economic disruptions is forcing companies in most industries to confront various challenges. The sales organization is consequently being asked to maintain sales volumes and profit margins (or minimize contraction as much as possible), while reducing organizational costs. How sales organizations respond in the next several months or quarters will play an important role in how well companies successfully navigate this turbulent period. Rather than just hope that things will get better, sales leaders should consider and act on several focus areas at their disposal to boost performance, while using this period as an opportunity to reset the sales force for a new cycle of long-term growth. The strategies necessary to successfully navigate an uncertain economy are beneficial strategies that, as a best practice, should be considered regardless of the economy.

For more advice and information regarding recession-proofing your sales force in times of economic uncertainty, please reach out to one of the authors or write to [email protected].

To read more articles on how rewards professionals can respond to the COVID-19 pandemic, please click here.

Use our dynamic reporting tool to download and view results of our latest pulse survey on setting the stage for a return to work and the new normal.

COVID-19 Disclaimer: This document has been provided as an informational resource for Aon clients and business partners. It is intended to provide general guidance on potential exposures, and is not intended to provide medical advice or address medical concerns or specific risk circumstances. Due to the dynamic nature of infectious diseases, Aon cannot be held liable for the guidance provided. We strongly encourage visitors to seek additional safety, medical and epidemiologic information from credible sources such as the Centers for Disease Control and Prevention and World Health Organization. As regards insurance coverage questions, whether coverage applies or a policy will respond to any risk or circumstance is subject to the specific terms and conditions of the insurance policies and contracts at issue and underwriter determinations.

General Disclaimer: The information contained in this article and the statements expressed herein are of a general nature and not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information and use sources we consider reliable, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without the appropriate professional advice after a thorough examination of the particular situation.

Related Articles