With the private banking business under operating pressure and continued disruption from the pandemic expected, firms cannot afford to wait any longer to address tough decisions to control people-related costs.

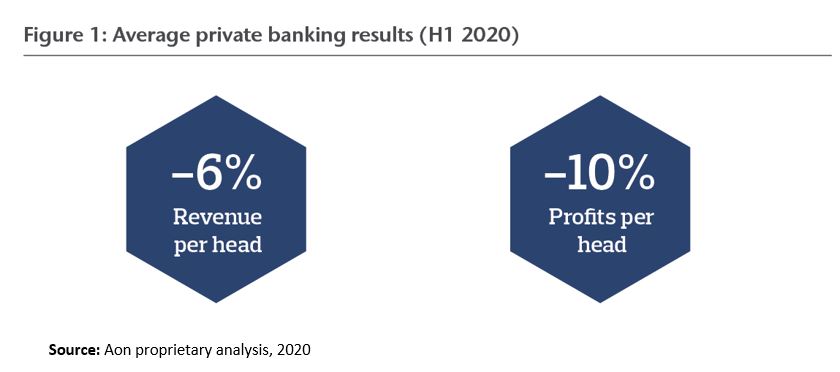

The economics of the private banking business have been under serious pressure following a difficult and exhausting 2020. On average, firms as of mid-year were seeing a 6% decline in per head revenues and profitability is under even more strain, down by 10% per head. While the second half of 2020 certainly showed signs of recovery, firms still remain focused on how to most efficiently drive growth in 2021.

The economics of the private banking business have been under serious pressure following a difficult and exhausting 2020. On average, firms as of mid-year were seeing a 6% decline in per head revenues and profitability is under even more strain, down by 10% per head. While the second half of 2020 certainly showed signs of recovery, firms still remain focused on how to most efficiently drive growth in 2021.

Further, with COVID-19 disruption set to continue into 2021, there is limited relief in sight. Firms cannot afford to wait any longer to address tough decisions, leaving senior leaders with the unenviable task of having to overhaul their strategies to preserve margins in the midst of a crisis.

Until relatively recently, firms could all but rely on steady revenue growth by making increases to headcount and winning new clients. Sales staff would be added and sales incentive plans used to support the generation of new business and boost year-on-year sales. Looking ahead, however, these well-trodden pathways to growth will need to evolve.

Scrutiny of cost management and operating expenses is intensifying. Today’s context of fee and spread compression have, in any case, rendered the traditional growth lever of salesforce recruitment less powerful. Meanwhile, the significant pressure on revenue and profit is undoing the hard work of the recovery years since the global financial crisis.

Rather than bouncing back to the old trajectory, firms must find a new route to sustainable growth. In this article, we argue that combining strategic initiatives around incentive plan design, location strategy and digital could lead the way for stronger footing.

Positive Steps Taken to Improve Compensation Control

Beginning on a positive note, management teams have come to the realization that better control of staff costs can be attained by improving the balance between formulaic sales awards and pool-funded annual awards. There is a clear rationale behind this shift in thinking.

Overall revenue growth has been weak, but formulaic sales commissions must still be paid to reflect new business generated for the firm. Sales awards have been tracking in line with prior years, despite the constraints on 2020 annual bonus pools. However, maintaining a formulaic approach makes it challenging to manage rewards since the total compensation pool is shrinking in line with reduced profits.

At a virtual roundtable we held for the wealth management industry in October, several HR leaders indicated that they are now striving to improve the balance of total incentive spend, primarily by shifting more dollars into annual bonus pools. This revised approach is an important first step in the right direction, as annual bonus awards offer HR leaders and finance more flexibility than the use of a formulaic method.

Further Developing Incentive Plan Design

It’s important to note that reducing sales incentives is not a silver bullet. It comes with the risk of advisor attrition, impairing revenue, or, less dramatically, lowers morale and depresses effort and revenue growth. The challenge is to maintain some line of sight between pay and performance, while achieving a better balance in pay awards between individual and business performance.

To solve this profitability problem, firms should adopt a broader set of performance metrics. The context of fee compression and spread compression should encourage internal discussion around what advisor behaviors are needed now to generate longer-term revenue growth.

This could involve measuring and rewarding advisor efforts that improve the incidence of financial planning among clients or recognizing advisors who have worked diligently to improve their client experience (CX) results, which we've seen linked to higher productivity. Advisor-level scorecards could help track these strategic behaviors.

Whichever levers are ultimately pulled, they must be reinforced by incentive plans that make it worthwhile for advisors to address holistic revenue opportunities, rather than only new sales.

New Location Strategies Could Improve Economies of Scale

Anecdotally, wealth managers tell us that work is already underway on overhauling location strategies to unlock cost saving opportunities. Organizational hierarchies that seemed fit for purpose in early 2020 are also being reexamined in light of economic pressures on the business.

Rather than simply cutting back overall staff numbers, firms should follow a more focused approach to reevaluate the client-team model, taking into account the locations and structuring of certain roles now that remote work appears to be here to stay in some way, shape or form. Team leaders should be asking themselves: Do we need so many field-based service and support roles? Which role responsibilities can be consolidated? Can we re-deploy staff or do we need to re-hire?

Over time, this may result in the relocation of certain roles in lower-cost locations and the consolidation or "repurposing" of headcount elsewhere.

Tech Investments to Target Efficiency Gains

Needless to say, technology has a critical part to play in helping firms shift gears on profitability. While wealth managers have good intentions when it comes to investing in technology, overall, the industry has been slow to realize the efficiencies and benefits of streamlining advisor work.

Investments to date have focused on providing a 360-degree view of the client – undeniably helpful for relationship management. But comparatively, less effort has been dedicated to identifying how to alleviate certain advisor tasks.

.PNG)

Our 2019 study with WealthTech firm Appway, indicates that enhancing the self-service capabilities available to high-net-worth (HNW) clients may be one option. Investors could experience efficiency gains by completing certain tasks independently, as long as their digital experience is intuitive and supported by both content and insights. This could also free up much-needed capacity in client-facing roles.

Start Planning Ahead Now

To avoid flying blind, wealth management firms must use high-quality data to decide their next steps. Staffing analytics, for example, could help optimize the team composition needed for the workforce of the future. Data on aggregate compensation spend and tech spend benchmarking could also guide effective choices on talent and technology that will improve profitability.

Still, maintaining a focus on growth is inevitable, which will pose a medium-term challenge to an industry that is facing the existential threats of a changing demography, fee compression and agile, new competitors.

Stock markets remain strong, causing some firms to conclude that COVID-19 is a ‘black swan’ event rather than a systemic unravelling. But firms must think past the crisis and carefully consider their incentive strategies, ensuring sales metrics are still present, while determining now what additional measures – particularly around the client experience – are needed to find a new path to long-term growth.

Related Articles