With demand for relative total shareholder return (TSR) on the rise, it’s important to understand the full scope of disclosure requirements to avoid future risk. This article outlines what you need to know.

In recent years, the popularity of performance-based equity awards with relative total shareholder return (TSR) metrics has risen considerably. As these plans become more popular, auditors, regulators, shareholders and proxy advisors have stepped up their scrutiny of how these plans are being described in public filings. Disclosure can include basic overview statements in proxy filings (Form DEF 14A), including target metrics and peer groups, as well as the publication of plan document details in periodic filings (Form 8-K). However, we believe the greatest disclosure risk resides in two key areas:

- Annual financial reporting via Form 10-K, specifically discussions of share-based compensation arrangements under ASC Topic 718

- Timely and accurate reporting of Section 16 officer transactions in Form 4 filings

This article takes a closer look at the requirements for each to ensure your firm is properly prepared.

Annual Reporting via Form 10-K

While Regulation S-K provides the overarching disclosure requirements for SEC registrants in the United States, disclosure requirements for share-based payment arrangements are detailed as part of the accounting guidance in ASC Topic 718-10-50-1, which states that public companies must discuss the following issues as part of their annual Form 10-K filings:

[Companies] shall disclose information that enables users of the financial statements to understand the following:

A. The nature and terms of such arrangements that existed during the period and the potential effects of those arrangements on shareholders

B. The effect of compensation cost arising from share-based payment arrangements on the income statement

C. The method of estimating the fair value of the goods or services received, or the fair value of the equity instruments granted (or offered to grant), during the period

D. The cash flow effects resulting from share-based payment arrangements

It is important to note that these disclosures are explicitly excluded from interim (Form 10-Q) filings by the accounting literature.

ASC 718-10-50-2 continues to explain in laborious detail the information needed to satisfy the requirements above; however, as it is intended to address all forms of equity instruments, we will summarize the information relevant to TSR disclosures.

The Impact on TSR Disclosures

Disclosing the nature and terms of relative TSR plans is fairly straightforward. At a minimum, companies must disclose requisite service periods and other substantive award conditions, including vesting conditions or criteria (i.e., levels of return required to achieve target payout), the maximum contractual term of the equity instrument (i.e., the performance period for the plan) and the target number of awards granted. Additionally, many companies voluntarily disclose the number of shares associated with maximum performance levels. Together, this information gives shareholders and regulators a broad overview of share-based payment arrangements.

While meeting the requirements of bullet A above is rather straightforward, bullet B requires a larger volume of disclosures. Companies must provide a clear picture of annual award activity in the current income statement, including:

- The number of non-vested equity instruments at the beginning of the year

- The number of non-vested equity instruments at the end of the year

- The number of equity instruments that were granted, vested and forfeited during the year

- Total compensation cost for share-based payment arrangements, including those recognized on the income statement and capitalized on the balance sheet

- Total compensation cost related to non-vested awards that has yet to be recognized; the weighted-average period over which it is expected to be recognized should be disclosed as well

This section should also include the weighted-average grant-date fair value for each of the equity categories. Further, for each year an income statement is provided, the weighted-average grant-date fair value should be disclosed for equity grants during the year. When disclosed together, this information allows users of the financial statements to understand both the compensation cost and volume of shares used in share-based payment arrangements (known as the equity burn rate).

As compensation expense related to TSR awards is entirely non-cash (until and unless the grantee pays cash for taxes upon vesting), the income statement effect disclosed to fulfill the requirements for bullet B also relates to bullet D. This amount should be included in the Statement of Cash Flows, along with any expense related to additional types of awards, as an add back to net income when reconciling beginning/ending cash balances and net income from the period.

Finally, bullet C requires companies to disclose the method used to determine the fair value of awards granted or offered during the year. This is the area where we most frequently observe opportunity for improvement, both in terms of communication and specific methodology decisions. While the accounting guidance permits several methods for determining the fair value of equity awards (for example, the Black-Scholes formula, which is predominantly used for stock option valuation), we have found that a Monte Carlo simulation is the most prevalent valuation methodology used for relative TSR valuations. This technique is preferred because it has the best ability to incorporate a variety of plan features and market conditions, whereas the Black-Scholes method is more limited.

Weighted Average Assumptions

When assessing the fair value of equity awards with relative TSR metrics, the following bullets outline key inputs and considerations for the Monte Carlo approach. These inputs should be reflected in public disclosure documents, both by a description of the input and the value used in the calculation:

- Expected Term – This is generally the same length as the performance period of a relative TSR award. Additional vesting conditions, such as continued service beyond the performance period, should also be disclosed.

- Expected Volatility – This plays a pivotal role in valuing any equity award with a market-based component, and there are several valid means to generate this assumption. As such, disclosures should summarize:

- The method used to calculate the volatility assumption

- The specific assumption used, (i.e., the calculated volatility)

Additionally, we recommend including additional information on peer group volatilities – either an average or range – to help the users of the financial statements assess the method used to calculate the volatility assumption

- Risk-Free Rate – Companies are required to disclose the risk-free rate that applies toward the valuation of a performance award. The risk-free rate is normally equal to the yield of a zero-coupon U.S. treasury bond with a term commensurate with the remaining performance period. If multiple risk-free rates are used (for example, if there are multiple relative TSR award grant dates), the range of rates should be disclosed.

- Expected Dividends – Dividends paid during the performance period impact the fair value of an award in two ways: first, the TSR itself, which would have dividends reinvested, accrued, or in rare cases, ignored, and second, dividend equivalents, which are typically paid on actual shares earned. Companies should disclose their expected dividend yield as well as their treatment of dividend equivalents.

- Discount for Post-Vesting Restrictions – If an award agreement includes a post-vest holding requirement, both the method for estimating the impact of the hold period and the resulting discount applied to the valuation should be disclosed.

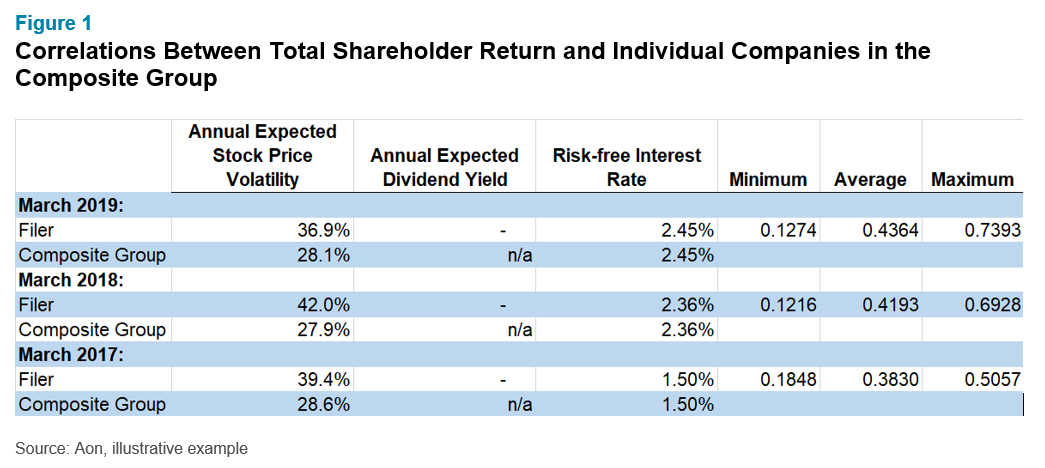

- Correlation Coefficient – The correlation of stock prices between a company and each of its peers is an important assumption in the development of fair values for relative TSR awards. Although companies are not explicitly required to disclose correlation information, we believe it is a best practice.

Some companies already choose to disclose correlation coefficients in their 10-K filings. Firms with percentile rank plans can also disclose coefficient data by providing the average or median pairwise correlations between members of the peer group. The excerpt below serves as a good disclosure example to follow:

We believe that, although some companies elect to disclose correlation information to increase transparency with investors and regulators, this decision should not be taken lightly. Since correlation is not necessarily relevant to all issuer filings, in most cases, it can be excluded. However, the facts and circumstances surrounding each issuer’s awards should be assessed when determining whether to disclose correlation information. We encourage you to seek guidance from your auditor before moving forward.

Section 16 Officer Reporting via Form 4

Under Section 16 of the Securities Exchange Act of 1934, "insiders" must file statements of derivative security ownership with the SEC via Form 3, Form 4 and Form 5 filings. For the purposes of Section 16, equity awards are considered derivative securities. Form 4 filings serve as intermediate updates as security ownership changes between starting and ending tenure as a Section 16 officer. This typically must arrive at the SEC within two business days of an ownership event. Often, these time constraints can result in severe business pressure during the disclosure process. With the current state of the economy and the increasing prevalence of remote work, such reporting requirements can become even more demanding.

When a company grants an award with vesting tied to relative TSR results, there is no obligation to file a Form 4 on behalf of the award recipient at the time of grant, since performance awards with relative TSR metrics are not treated as derivative securities. This is because the amount ultimately paid to the award recipient is based in large part on the performance of other companies. In other words, these awards lack a specific stock price target, which is a requirement of Section 16 to be classified as a derivative security.

As a result, Form 4 disclosure of equity awards with relative TSR metrics should occur within two business days of the end of the performance period, or whenever awards are no longer subject to any performance conditions. At this time, the number of earned shares as a result relative TSR achievement should be reported for each Section 16 officer recipient. For example, a company would file a Form 4 on Tuesday, February 11 for a relative TSR plan with a performance period ending on Friday, February 7. Included in the filing is a footnote detailing the nature of the award, as well as the target number of shares. While not included in this footnote, some companies elect to detail the performance criteria or relative index in the Form 4 footnote as well.

Form 4 reporting can be complicated along several fronts, including the determination of derivative vs. non-derivative securities, managing data to meet quick-turnaround timing requirements and providing sufficient award details in Form 4 footnotes (especially vesting details). We strongly encourage companies to plan ahead to ensure they have the proper resources in place to assess and report final relative TSR award outcomes in a timely manner, particularly in light of increases in remote work arrangements.

Next Steps

We expect the use of market-conditioned, performance-based equity awards with relative TSR metrics to continue to grow. With this growth, scrutiny will certainly be on the rise for both companies implementing these award plans for the first time, as well as those adjusting their plans as a result of the current economic crisis. In a time of increasing investor activism, we encourage companies to consider being as transparent as possible in their disclosures, including the disclosure of peer volatilities and correlation coefficients in annual Form 10-K reports, and to invest in superior and efficient reporting mechanisms to deliver accurate Form-4 disclosures within two business days of relative TSR award payouts.

If you have questions about this topic and want to speak with one of our experts, please write to rewards-solutions@aon.com.