In the fourth quarter of 2022, our ESG and Corporate Governance Advisory team conducted a pulse survey of more than 120 companies in the Middle East on their ESG practices. We find that Middle Eastern companies are now thinking about ESG and readying to institute more formal policies and procedures. We can see they are taking action. But is it enough? And if not, what help is needed? Our article discusses key findings from the survey and trends on addressing ESG in the Middle East.

To receive a complimentary ESG Diagnostic for your organization or to receive a copy of the full survey results please reach out to humancapital@aon.com.

Here are the top three ESG trends in the Middle East:

1.Human capital management (HCM) topics take priority over environmental issues

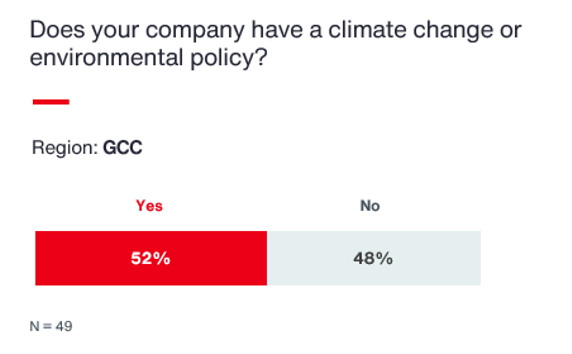

Nationalisation is the highest focus, with formal policies already being put in place. Organisations are more devoted to establishing clear and targeted HCM ESG initiatives, such as diversity, equity and inclusion, rather than climate-focused strategies. Only 47 percent of surveyed companies have any formal climate policy.

2. The Middle East is currently lagging on formal ESG ratings and reporting

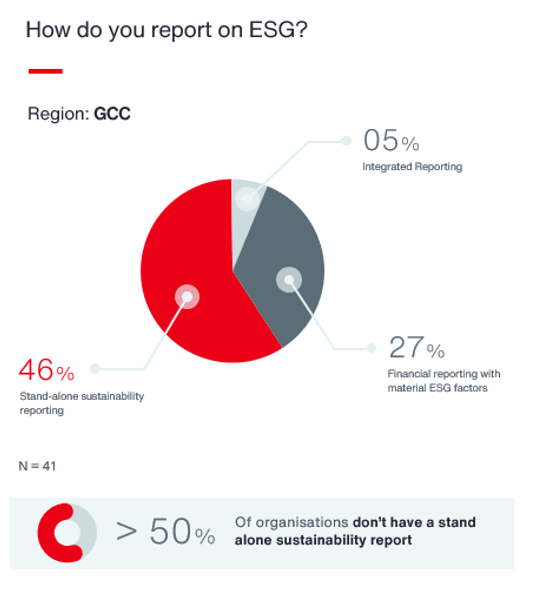

Only 42 percent of participants citing they have a standalone ESG report. However, this is on the upward trend, with most participants stating they are in the process of establishing formal reporting frameworks such as GRI. The Middle East region is quickly catching up to global peers regarding ESG efforts. If companies want to attract foreign investment and meet government environmental pledges, they must establish formal ESG reporting standards and ensure their company strategy really supports ESG goals.

3. Boards care about ESG, but formal oversight is lagging

Nearly three quarters (73 percent) of respondents say their board is involved in defining ESG for their company, demonstrating the board cares about ESG. For there to be real progress toward achieving goals, there needs to be more accountability at the board level. The Gulf Cooperation Council (GCC) lags in this area. With only a small percentage of companies tying executive compensation and incentives to formal ESG metrics, there is still progress to be made in this area.

Why ESG is Important in the Middle East

The United Arab Emirates Securities and Commodities Authority (SCA) now requires public joint stock companies listed in the UAE to adhere to specific ESG disclosure requirements. This affects over 130 companies and requires they act. The rest of the GCC is also catching up; the fact the Saudi exchange has published ESG guidelines puts increasing pressure on listed companies to report their progress. By incorporating ESG into the way the financial ecosystem operates, it helps create an economically efficient and sustainable financial structure that contributes to long-term value creation.

GCC countries and their companies will need to move faster and take bigger steps if they want to attract foreign investment in a competitive market, especially as ESG ranks higher when making major investment decisions.

GCC states, which have historically lagged other regions in the global movement towards better governance, are now having to catch up fast, as they tackle gender diversity, board independence and corporate disclosures all at once. Responses across our survey show that companies are now aware of the issues; over 60 percent of respondents have already put policies and procedures in place to improve their ESG performance or they are taking steps to do so.

The Current State of ESG in the Middle East

Because GCC countries are heavily reliant on fossil fuels for energy, they are considered the most at-risk nations for the effects of climate change with disastrous environment consequences such as desertification, water scarcity and unliveable temperatures. Governments in the GCC are diversifying their economies away from fossil fuels, investing heavily in renewable energy and tackling water reuse and recycling. With the Emirates to host COP28 in November 2023, the UAE will soon initiate an annual sustainability year and dramatically increase its efforts to target the reduction of greenhouse gas emissions. The goal is to achieve net zero emissions by 2050, and Saudi Arabia’s sovereign wealth fund is also targeting net-zero emissions by 2050. However, to realistically achieve this goal, we believe that policymakers need to do more to clearly outline their ESG goals; presently a lack of formal governance around ESG is impeding progress.

As you might expect, we found a strong awareness of ESG, with 73 percent of respondents reporting their board had defined what "ESG/sustainability means to the company." Of those, 58 percent agreed they had defined which ESG elements were important to them and which goals and activities were needed to achieve their ESG objectives. Yet, while defining ESG goals is good, companies need a roadmap for converting these plans into actions.

ESG reporting in the GCC

What gets measured, gets managed. Here is where companies in the GCC need to up their game. The survey findings indicate that while almost three out of four GCC boards are involved with creating an ESG vision and mission, ongoing follow up and action is mostly delegated to committees. Only 10 percent of survey participants stated they are following the GRI (global reporting initiative) framework of ESG reporting; further probing would be required to understand the different reporting frameworks, if any, that organisations are currently using.

Creating oversight and ensuring governance requires policies, procedures and people to make it happen. While over half of the GCC companies are doing standalone reporting, they are behind their peers in other regions that have instituted separate annual ESG reports and board oversight of ESG topics in place.

Diversity, Equity and Inclusion Are on the Agenda

Only 33 percent of GCC respondents have a formal diversity, equity and inclusion policy for the board and management, which shows there is more required from boards to drive progress. While the social factors of ESG have become a big focus, there is little sign of strategy. Knowing that you have a problem isn’t the same as solving it. Without a concrete, actionable ESG strategy and dedicated staff in place to drive implementation, GCC companies are going to struggle to make the changes needed to keep up with their international market peers. While there is much happening around nationalisation and the growth of women in leadership, there is much to be done to keep pace with changes elsewhere in the world.

Monitor the Big Picture and See How Your Organization Is Perceived

Aon’s ESG advisory practice can support your organisation on your ESG journey and meet you where you are at. Reach out to us for a demo of our new Digital Business Insights Platform, a powerful online platform that combines data and analytics about your organization so you are in the loop in real time and can manage and mitigate risks proactively. With a crystal-clear view of where you stand compared to your competitors, you can talk to your stakeholders from a fully informed position about your company. You can set a solid foundation that you and your senior team can use to base strategy upon, and by being better informed, you will be equipped to have the important, knowledgeable conversations that will set you apart from the rest when it comes to ESG.

As Aon continues to help clients navigate their ESG journey, we can develop for you a free sample of our ESG maturity diagnostic, providing high-level insights on your firm's ESG progress, driven by data and analytics.