Many organizations feel overwhelmed with the high stakes involved in effectively addressing ESG risks. Moving from a practical to a tactical approach provides firms with the agility to measure and track progress on their ESG strategy.

Overwhelm is a common denominator for companies beginning, enhancing or pivoting in their environmental, social and governance (ESG) journey. Businesses are struggling to sustain a competitive edge with pandemic-driven workforce and supply chain challenges, while striving towards more robust strategies aligned with evolving ESG regulations. With new requirements and standards for climate and human capital disclosures, the pressure is mounting for companies to meet investor and regulatory expectations, align with peers, and perhaps most significantly, to sync with the moral obligations of our time.

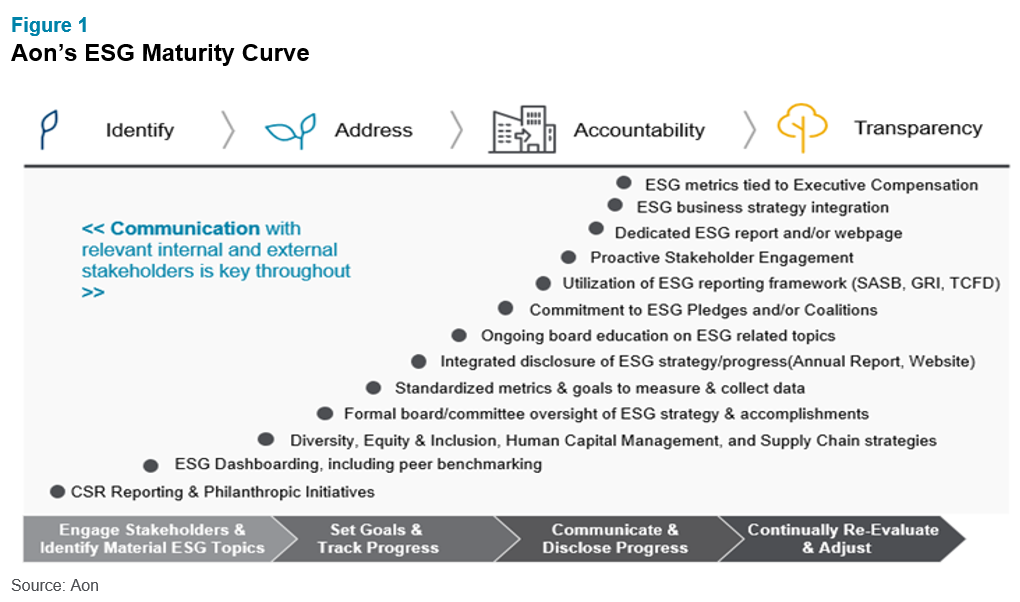

A practical approach involves addressing oversight of the most material steps in your ESG strategy to relieve this sense of being overwhelmed. For example, have you identified governance entry points to ground your approach, enhanced your current ESG initiatives, and offered clarity of purpose? Aon’s ESG maturity curve illustrates the practical to tactical trajectory that guides next steps no matter where your organization is on the curve.

Begin this practical journey by reflecting on your company’s identity, purpose and public disclosures to communicate core values to your customers and the marketplace. Posing the following questions at the board and management level are key to navigating along the ESG maturity curve:

Traversing to a Tactical Approach

Once you are grounded in identifying and addressing your primary ESG risks through a proactive and practical approach, the next steps in your ESG journey are the most important. It’s time to make a strategic transition to a more tactical approach. This means digging into being accountable to ESG business integration in all verticals of your company. For example, a practical step may be avoiding a “no vote” campaign against the board by creating a board diversity matrix. A tactical approach would go deeper into integrating diversity and inclusion programs and policies within the company. Next steps may involve input from a variety of stakeholders and include refreshing the board with new and diverse members, disclosing board committee oversight of diversity and inclusion, and considering a pay equity audit.

With ESG regulations and investor expectations changing rapidly, it’s important to stay informed. Measure where you are today to get grounded in the data and then commit to continual education. It’s important to stay current on ever-changing regulatory and investor factors, as well as know what is important to your employees, customers, and the communities in which you operate. Understanding these drivers will help you adapt and navigate.

Consider the following questions to guide your next steps and decision-making:

- What is your leadership’s governance vision and willingness to act on ESG goals? Stay accountable to these goals all the way up to the boardroom and c-suite levels.

- What two or three actions could you implement or make more transparent in the next 12 months to be more aligned with industry peers? Be specific with these actions so progress can be measured.

- How and where do you enhance ESG levers for efficiency and to ensure human capital and resource management across your value chain? This is a critical area where organizations can pivot from a practical to a tactical approach.

Next Steps

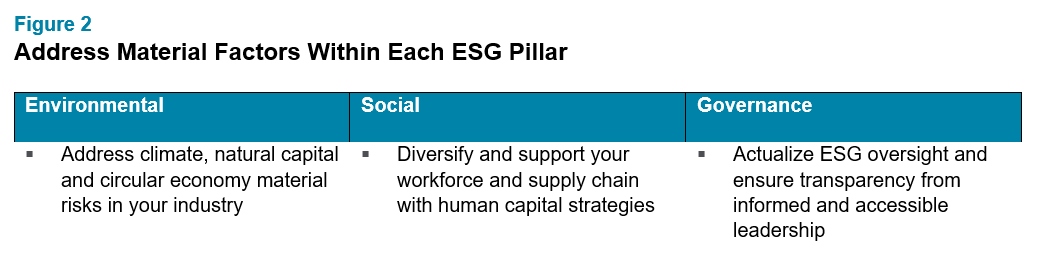

Proactively managing your company’s narrative and the change you hope to drive is critical to getting one step closer to achieving your ESG goals — and transparency is key throughout. As an organization transitions from a practical to a tactical ESG approach, establishing board oversight will ensure accountability. Evaluate material factors in each ESG pillar in order to plan strategic actions. The key to ESG integration is empowering people and resources with the agility to move across the three pillars (outlined below).

Moving from a practical to tactical position often results in two steps forward and one steps back. For example, your organization may have put a more robust auditing system in place to monitor your supply chain, but now your auditors have limited access due to changing socio-political circumstances. Or consider the coronavirus (COVID-19) pandemic, which caused so many businesses to feel under-resourced and ill-prepared when it came to employee health and wellbeing, supplier relations and workplace safety — highlighting how companies are now leaning into a “new better” governance strategy.

Planning and implementing a solid ESG foundation means your company is better suited to face these challenges. Look around, evaluate market drivers, and remap the ESG climb up the maturity curve. Patience and agility can coexist. Both, in fact, are necessary for the adaptive ascent.

*****

Aon’s global governance and ESG advisory services have the expertise to help your company move up the ESG maturity curve, pivot to tactical change and ultimately make transformative and sustainable decisions. To speak with one of our experts about this topic, please write to humancapital@aon.com.