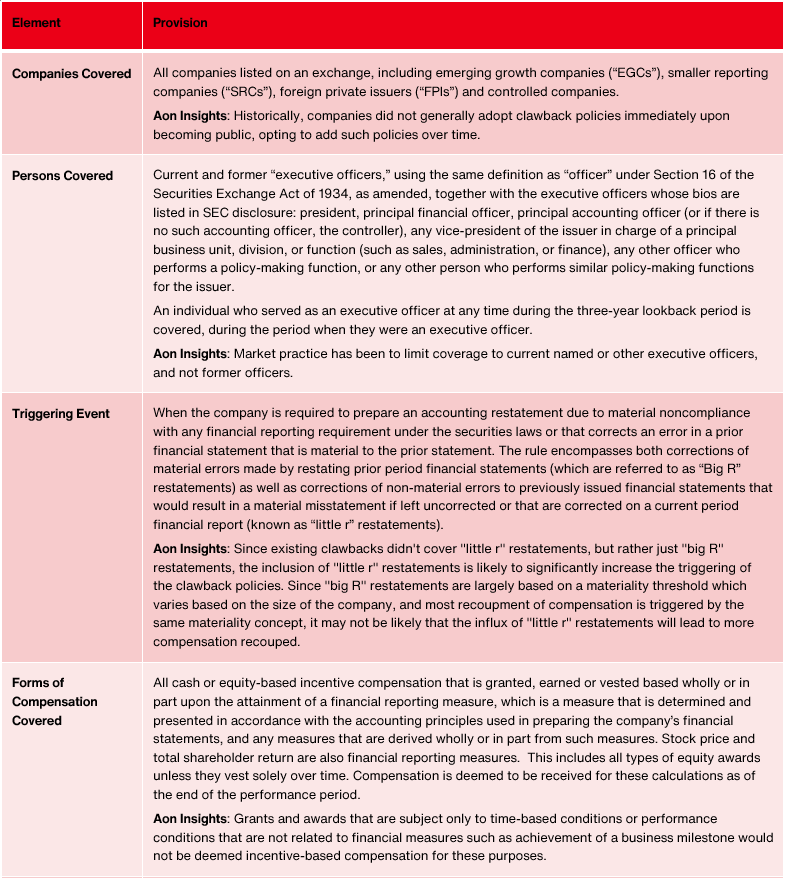

On October 26, 2022, the U.S. Securities and Exchange Commission (SEC) adopted a final rule directing listing exchanges to require that publicly traded companies adopt a compensation clawback policy. Virtually all listed companies, including emerging growth companies (EGCs), smaller reporting companies (SRCs), foreign private issuers (FPIs) and controlled companies will be subject to the new U.S. rule, with no exceptions or phase-in periods.

Why did the SEC Adopt This Rule?

The compensation clawback rule was mandated by Congress in 2010, under Section 954 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act). That section required that the SEC adopt rules under which companies would be required to develop policies to recover “erroneously awarded compensation” from a covered executive if incentive compensation was based on a misstated financial measure (including stock price and total stockholder return), because the company was required to prepare an accounting restatement. The clawback rule is the last of the executive compensation regulations to be finalized by the SEC as required by the Dodd-Frank Act.

What Does the Rule Require?

The final SEC rule directs the national securities exchanges, including Nasdaq and NYSE to require companies listed on their exchanges to adopt a clawback policy that complies with the new rule or listing standard – a company can be delisted if they fail to act. The next step will be for the stock exchanges to add specific clawback policy requirements to their corporate governance listing requirements. After new listing standards are adopted, a listed company will have to:

1) adopt a clawback policy meeting the requirements of the rule/listing standard,

2) comply with the clawback policy, and

3) make required disclosures about the clawback policy.

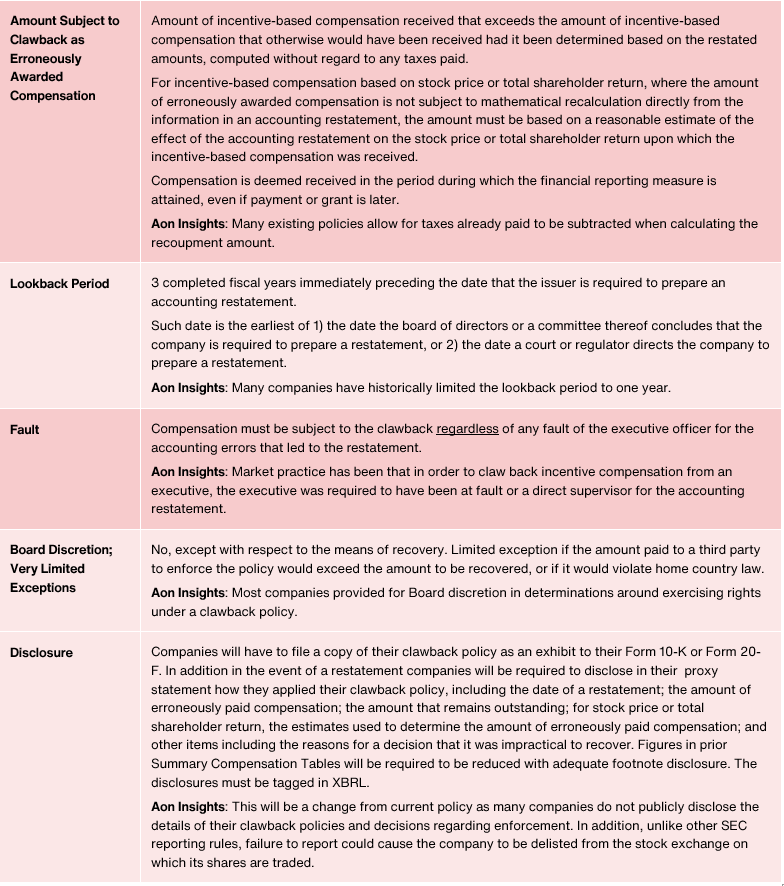

The rule requires that a company’s clawback policy must provide that if the company is required to prepare a financial restatement, the company will recover the portion of incentive compensation paid to its current or former executive officers based on any misstated financial measure. The policy must apply to compensation received during the three most recently completed fiscal years before the date the company is required to prepare the restatement.

The rule encompasses both corrections of material errors made by restating prior period financial statements (which are referred to as “big R” restatements) as well as corrections of non-material errors to previously issued financial statements that would result in a material misstatement if left uncorrected or that are corrected a current period financial report (known as “little r” restatements).

Companies will be required to file their clawback policies with the SEC as an exhibit to their annual reports (filed on SEC Form 10-K for U.S. companies, Form 20-F for FPIs, and Form 40-F for Canadian companies with securities registered in the U.S.). They will also have to disclose any restatement and any application of their clawback policy by checkmark on the cover of their annual report, as well as any actions taken to recover, or the reasons for a decision that it was impractical to recover i.e., erroneously paid compensation.

Companies are prohibited from indemnifying current or former executive officers against the loss of compensation based on a misstated financial measure clawed back under this policy.

When Does a Company Have to Adopt a Clawback Policy That Complies With This new Rule?

Unlike the SEC’s recent pay versus performance rule, there is some time before a company has to adopt or modify its clawback policy. The timing of this begins 60 days after the SEC rules are published in the U.S. Federal Register. The listing exchanges have 90 days after publication to propose new requirements to their corporate governance listing standards to the SEC, and the exchanges have up to one year thereafter to add these new requirements to their corporate governance listing standards, although the exchanges could put their standards in effect sooner. Once the listing exchange standards are effective, companies will have 60 days to adopt a compliant clawback policy. The SEC disclosure requirements do not begin until the company has adopted its clawback policy.

What Does the new Clawback Rule not Cover?

The new rule does not address the inclusion of a trigger based on misconduct unrelated to a financial restatement. Many companies’ current clawback policies include such a trigger, and we expect that these companies will retain this additional trigger as part of their new clawback policies.

What are Some of the Practical Aspects to Consider in Connection With the Final Rule?

The rule requires that the amount of erroneously awarded compensation subject to clawback be determined without regard to any taxes paid. As a practical matter, under existing clawback policies, companies have found it challenging to recover amounts previously paid to covered executives because taxes have already been paid on such amounts, the recipients have already redirected the funds and current tax rules make it difficult for executives to recoup these taxes. For current executives, companies may still effect a clawback by recouping from outstanding equity grants and cash incentive opportunities to recover the amounts required and thus not double penalizing executives for taxes already paid.

What are the Next Steps Companies Should Take?

Companies should begin educating the board of directors and senior management about the new requirements and review current clawback policies to see what changes will need to be made. Companies should also review existing employment and other agreements to ensure that they do not need to be amended, as well as foreign laws to determine if any provisions of such documents or laws conflict with the new requirements, and should address any such situations. D&O insurance policies should also be reviewed for any provisions that might conflict with the prohibition on indemnification.

The following is a brief description of the key elements of the rule:

The new Dodd-Frank compensation recovery rules will greatly expand the long-standing clawback provisions under Section 304 of the Sarbanes-Oxley Act of 2002, under which the SEC is authorized to require a company’s chief executive officer and chief financial officer to repay the company for any incentive compensation received over the preceding one-year period in the event the company is required to restate its financial reports due to misconduct.

The new Dodd-Frank compensation recovery rules will greatly expand the long-standing clawback provisions under Section 304 of the Sarbanes-Oxley Act of 2002, under which the SEC is authorized to require a company’s chief executive officer and chief financial officer to repay the company for any incentive compensation received over the preceding one-year period in the event the company is required to restate its financial reports due to misconduct.

The Aon Corporate Governance Team drafts and reviews compensation clawback policies; contact us to discuss the new rule and its application to your company, and the creation or amendment of a policy, in more detail.