The abundance of environmental, social and governance (ESG) ratings providers in the marketplace can be complex for companies to navigate. Aon has tips to help you manage various ratings and enhance your overall ESG strategy.

Since 1999, when the world’s first global sustainability index was introduced, ESG risks have steadily moved to the top of the agenda for many investors, shareholders and regulators. Today, ratings are used more than ever before to assess a company’s exposure to long-term ESG risks.

For many companies, the primary goal should be progressing effectively from a practical to tactical approach to managing and disclosing ESG information. The proactive management of ESG reporting and disclosures benefits organizations that are new to ESG ratings, ensuring that ratings providers have access to accurate information for their ratings calculations.

Before determining whether to interact with ESG ratings providers, companies should look to address two main challenges: sorting through the different ESG ratings and methodologies in the marketplace and dedicating the resources necessary to manage ESG data verification opportunities.

Here are several steps you can take to manage your company’s ESG ratings, identify topics of priority and stay ahead of financial stakeholder scrutiny and expectations.

Decide What ESG Ratings Providers Merit Your Primary Focus

The first step you should take is deciding what ESG ratings providers to prioritize. Consider the following questions when determining which ratings providers to engage with:

- What is Your Company’s Primary Purpose in Engaging an ESG Ratings Provider? You might be looking to inform investors about ESG practices, improve your rating, identify an accurate ESG benchmark for internal strategy or conduct an ESG gap analysis. Establishing the primary goal(s) you want to accomplish through engagement can help you maintain focus as you work through different ESG ratings providers, data points and methodologies.

- What ESG Ratings Providers are Most Relevant to Your Industry, Stakeholder Influence and Governance Priorities? Investors and insurance companies might be most concerned with firms that serve as ESG dataset providers, like CDP, DJSI and MSCI ESG Indexes. Other providers like S&P Global, ESG Book, Sustainalytics are increasingly used as directional datasets by financial stakeholders as well.

- What is Your Company’s Capacity to Engage With ESG Ratings Providers? Providers require varying degrees of your time to explain the company’s business and its programs, so determining in advance what providers require more information and what resources might be available internally will increase the likelihood of successful engagement with the ratings providers your company chooses to prioritize.

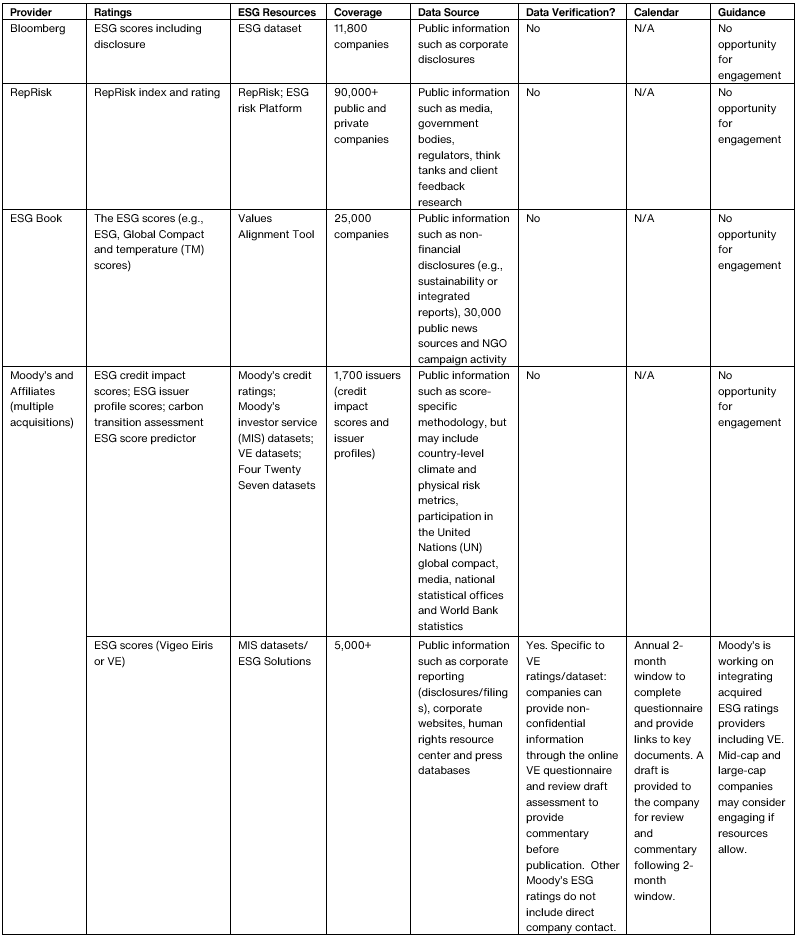

We encourage companies to ask these questions while considering the representative listing of ESG ratings providers provided at the end of this article (see Appendices A, B and C). We have grouped these ESG ratings providers into tiers based on their reach and your opportunity to verify company data.

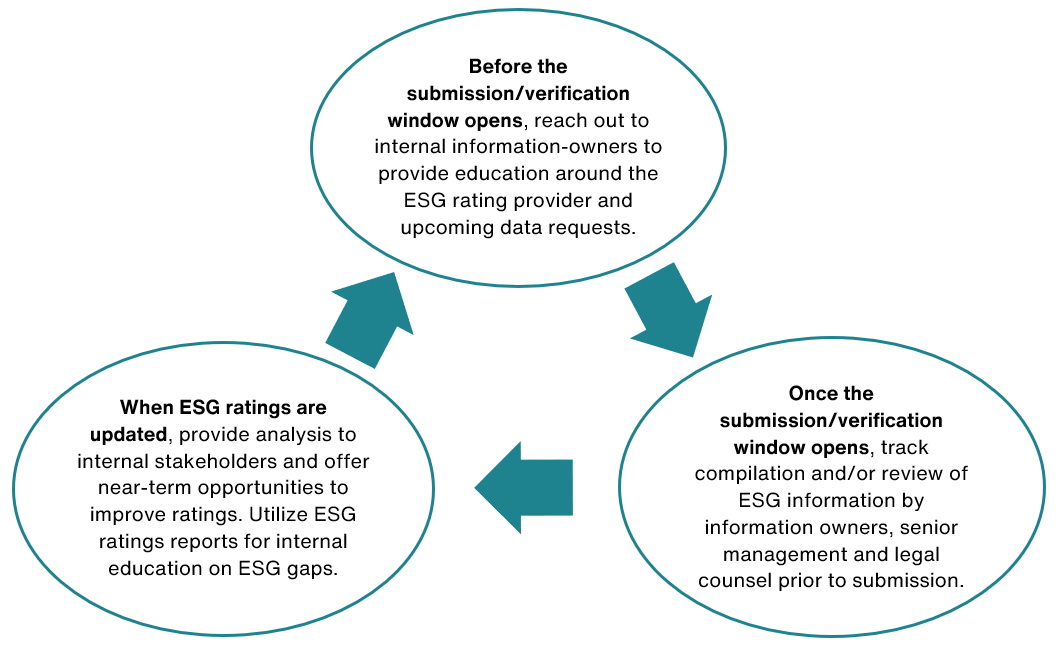

Figure 1 — Establish a Process for Managing ESG Ratings

Source: Aon

Improve Your ESG Disclosure Strategy

Once you have prioritized ratings providers for engagement, the more resource-intensive work of improving your organization’s ESG ratings can take shape. We encourage you to consider these organizational goals and actions:

- Encourage Greater Transparency and Accessible Disclosure of Material Impacts. Streamline reporting of ESG information into an ESG framework offered by the Sustainability Accounting Standards Board (SASB) or the Task Force on Climate-Related Financial Disclosures (TCFD). Your company might improve ratings by making more of your ESG-related strategies, policies, metrics and oversight disclosures easily accessible. Look to industry leaders, regulators, listing exchanges, investor preferences and ESG ratings providers’ surveys for guidance on additional disclosure and where to disclose the information.

- Lighten the Load for ESG Analysts. Ensure your ESG information details specific company initiatives, business coverage and outcomes versus general language, especially where ratings providers are looking at ESG-related strategy and programs. This is important if providers are using inaccurate or outdated information on your business or if analysts require a public source to verify implementation of strategy. If raters consider private information, you will most likely be required to submit a current form of verification (internal policy, SOP, etc.).

- Assess and Monitor Your Current ESG Rating Exposure. Understand how you fare across some of the more influential ratings, both on an absolute basis and against your industry peers. In many instances, entire industries fare poorly under certain ratings. This is important context that can help you determine if you are an outlier relative to industry peers or if there are simple improvements that can be made to put you in a better position than your industry peers. Companies can do this manually or use tools, such as Aon’s Digital Business Insights (DBI) platform to monitor ratings exposure through a real time data feed.

- Engage With ESG Rating Providers. Many ESG rating providers and consulting firms offer fee-based services that support companies with more in-depth ESG rating analysis, best-in-class disclosures and other information that can help a business improve its ratings. Building a relationship with the ratings analyst team that covers your company can help keep them abreast of your organization’s ESG milestones, ensuring timely updates to your rating.

- Provide Proactive Context to Financial Stakeholders. Be prepared to give specific company context about how you are faring on ESG ratings. Financial stakeholders, including investors and insurance companies, understand the limitations and the nature of ESG data as directional and are open to engagement on these topics. This is an opportunity for companies to manage the narrative on this topic and showcase sophistication and awareness with financial stakeholders that are evaluating the ESG risks of their portfolios. This can be accomplished through a thoughtful communication strategy, both in terms of public facing narrative disclosures and meetings with key financial stakeholders.

Next Steps

Investors and a growing range of other organizations are paying close attention to ESG ratings, whether as a screening tool or as a deciding factor in making investment decisions and risk assessments.

Once a company has committed to engaging with specific ESG ratings providers, it is vital that the business identifies internal owners of the engagement process, organizes internal stakeholders, and manages the compilation of data and disclosure, including a clear and consistent process for approval by the board and legal counsel for disclosure of information.

Improving ratings requires progression on an ESG maturity curve with incremental milestones that reflect enhanced corporate accountability on core ESG issues and increased transparency that highlights a company’s ESG commitments and accomplishments.

For more guidance on how best to improve your ESG ratings, please contact [email protected].

Appendix A

Tier One of ESG Ratings Providers to Engage

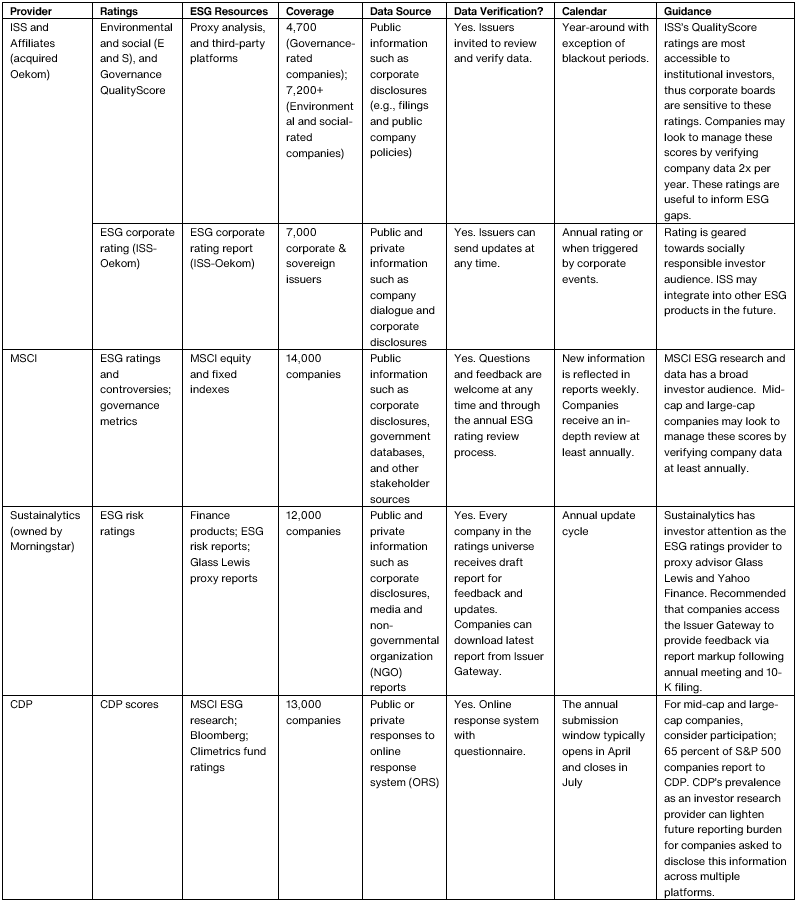

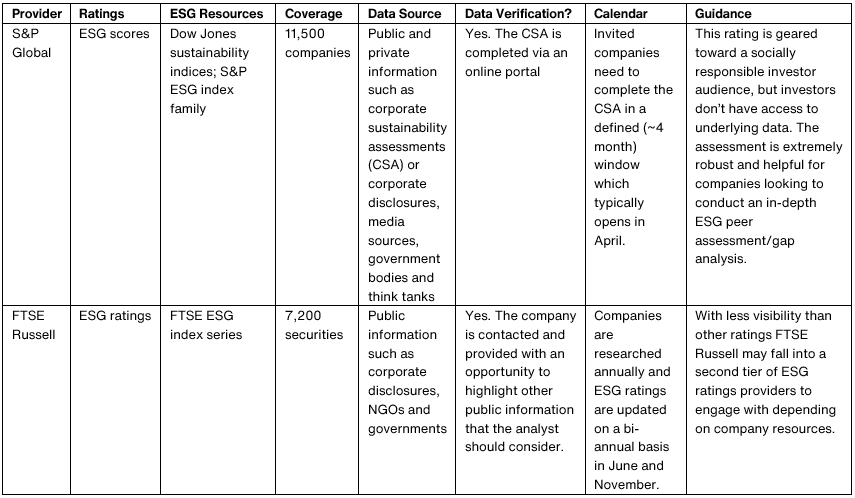

Appendix B

Tier Two of ESG Ratings Providers to Engage

Appendix C

Tier Three of ESG Ratings Providers to Engage