Introduction

Earlier this month, we published an article on rising voluntary turnover rates for sales professionals. While turnover is up across the board at technology sector companies, we discovered that sales professionals at software firms currently lead the pack when it comes to voluntary departures.

Our article prompted a number of interesting questions from clients, as well as from a few of our social media followers. For the most part, readers all wanted to know the same thing: what constitutes "high" turnover, and when should alarm bells go off that turnover is becoming a critical problem?

In other words, our readers want to know more about putting turnover data into a practical context. And so, to address your inquires, we decided to dig a bit deeper.

Defining High Turnover

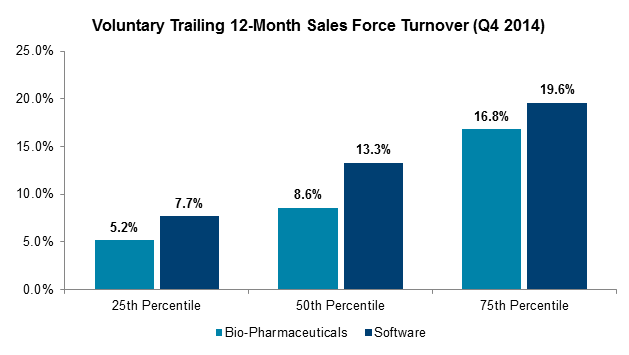

For our part, we believe the voluntary turnover figures cited in our previous article – a median rate of 13.3% for sales professionals at software companies – are high, and should raise concerns at companies experiencing similar levels of team disruption. Keep in mind, we reported median figures in our article, which means that half of all companies included in our dataset have higher departure rates.

For example, at the 75th percentile, trailing 12-month turnover rates for sales professionals at software companies hit 19.6% in our Q4 2014 Workforce Trends Report. That means at least 1 in 5 sales reps voluntarily left their positions at 25% of software companies in the last 12 months!

In contrast, in the very well-performing bio-pharmaceutical industry, the median voluntary turnover rate for sales professionals was only 8.6% over the same time period. That's a significant difference across two industries with similarly upbeat prospects, tremendous levels of innovation, and soaring stock prices.

To take our thinking a few steps further, let's look at the question in a slightly different light: what is the actual impact of 10% turnover (or more) on a company's sales goals? If 10% of your company's sales reps voluntarily left in a given year, would it debilitate your organization's growth plans? To illustrate the potential impact of 10% voluntary turnover on hitting revenue goals, we developed a quick case study:

A mid-size technology company with 250 total sales reps, who each have an average sales quota of $2 million, is experiencing 10% voluntary turnover. This means 25 sales reps leave each year, translating to a potential disruption of approximately $50 million in targeted annual revenue—a major hit for any mid-sized company. Of course, the business will recover some losses by onboarding new hires, but not without spending additional money, time and resources to hire and train new sales reps. Meanwhile, the 225 reps that didn't leave might wonder what their 25 departed colleagues knew that they did not— creating distractions, reduced engagement and even less productivity. Beyond the direct hit to revenue targets, the hidden costs of turnover can pile up.

Turnover, at a certain rate, can be healthy for any business, but we believe the ideal figure should be well south of 10%.

Turnover by Region

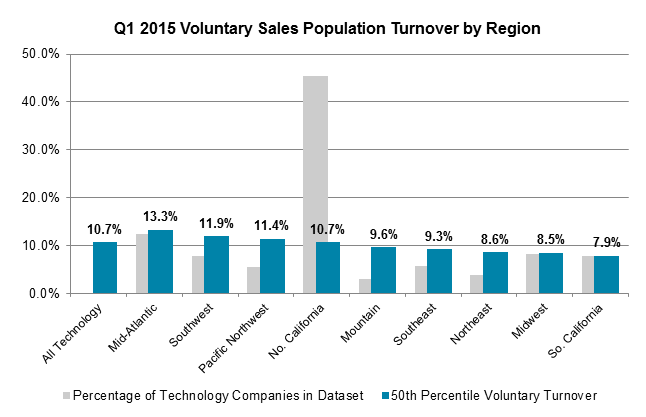

Many clients also asked us how turnover varies by industry and region. We discussed industry differences in our last article, so let's turn to the question of regional variations. Using Radford's new Q1 2015 Workforce Trends Report, we plotted sales force turnover at technology sector companies across all major US regions.

Median voluntary turnover is currently at 10.7% among all 240 technology firms reporting figures for their sales population. Segmenting the data by region, we can see that the Mid-Atlantic States followed by the Southwest, Pacific Northwest and Northern California regions are experiencing the highest rates of turnover. Southern California, the Central/Midwest and Northeast areas rank at the bottom, with median rates of 7.9%, 8.5% and 8.6% turnover, respectively.

Interestingly, when we compare the rate of turnover against the percentage of technology companies that are reporting data for each region, we find there is very little correlation between the number of companies in a region and the rate of turnover. Although the San Francisco Bay Area is home to almost half of all technology companies in our database, it ranks in the middle of the pack for voluntary turnover. The Mid-Atlantic States—reporting the highest rate of median turnover at 13.3%—is home to 13% of all technology firms, while the lowest region for turnover, Southern California, has 8% of the companies.

This data suggest that even if you're at company in a region with fewer technology firms, you still need to be concerned about your sales reps leaving. Conversely, areas like Northern California, with a high concentration of technology firms, aren't necessarily experiencing turnover at a higher rate— although, voluntary turnover is still above 10% and historically high.

Looking back at our previous article, industry, as opposed to region, appears to have a larger influence on sales staff turnover.

Conclusion

As we mentioned in our original article, there are several reasons that explain the rise in turnover among sales professionals in today's current business environment. Some level of turnover is inevitable, and is actually a healthy byproduct of an effective pay-for performance system. Under most scenarios, underperforming sales reps should receive lower commissions and some of those individuals will be prompted to look for different job opportunities. However, we believe the current rate of turnover is detrimental to sales and growth for many technology firms.

If human resources managers aren't doing so already, they should be carefully and closely tracking the reasons sales reps give for leaving during their exit interview or some similar process. These reasons should be plotted against the performance of the individual sales rep to see if patterns emerge. If there are differences between high and low performers' stated reasons for leaving, these facts will help HR and compensation managers make the necessary changes to potential issues like sales compensation plan design that will help them motivate and retain their very best sales professionals.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles