Using our survey data, we analyzed workforce planning and composition among e-commerce firms to understand how these firms are adapting their workforce for high growth.

The e-commerce industry is booming with growth at an annualized rate of around 15%, accounting for more than half of all retail growth, according to Digital Commerce 360. As e-commerce companies grow their business, their workforce composition naturally evolves. To better understand this connection, we leveraged the Radford Global Technology Survey data for e-commerce companies to compare large e-commerce companies (defined as more than 900 employees) to small e-commerce companies (less than 900 employees) on key workforce metrics, including job functions and job levels, mobility, gender, tenure and generational distribution.

Our analysis showed key differences between small and large e-commerce companies that can yield helpful insights for e-commerce businesses as they increase their headcount, take advantage of high demand for internet goods and services, and prepare for the next stage of growth.

How Job Functions and Job Levels Evolve with Growth

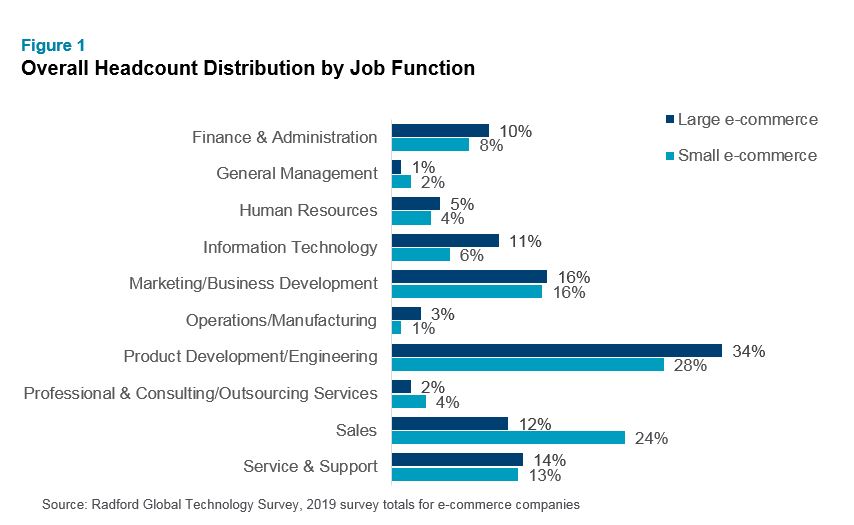

When we looked at the overall headcount by job function we found large e-commerce companies employ proportionally more product development and engineering employees, whereas small e-commerce companies have more of their workforce concentrated in sales functions as shown in Figure 1. This illustrates the change in business strategy as these firms scale for growth and pivot from investing proportionately more resources into the direct sales messaging to creating, designing and improving the effectiveness of their web environment. This is quite intuitive for e-commerce but also runs counter to what we typically see in the software industry where product development is the initial focus with sales coming after the product is somewhat proven.

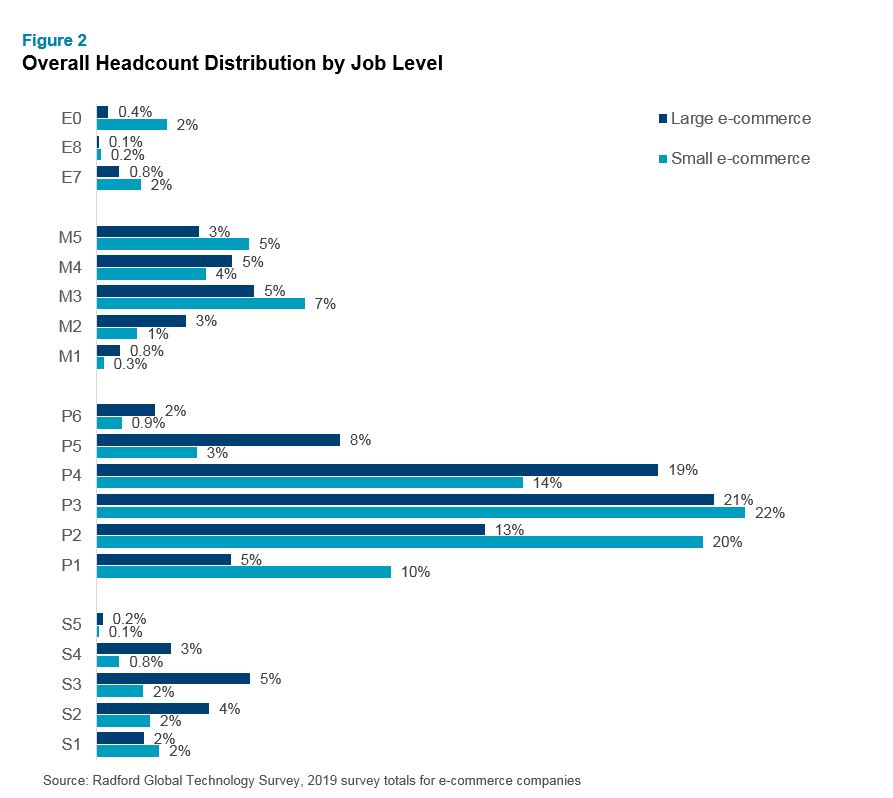

Turning to the distribution of job levels, we find larger e-commerce organizations follow the trend of traditional technology organizations (e.g., software and hardware firms) and become less top heavy proportionally with fewer executives and managers as shown in Figure 2. Conversely, larger e-commerce organizations invest heavily in higher level professionals (a P4 through P6 in the Radford surveys). Larger e-commerce firms need these critical positions to advance their product portfolio and website environment to drive revenue.

Employee Mobility Rates and Demographics

Examining overall workforce mobility patterns by employee turnover, promotion and new-hire rates, we found a lot of similarities between small and large e-commerce firms. In general, the e-commerce industry is very dynamic with lots of mobility moving into and out of organizations as well as promotions from within. The median promotion rate is 19% with a turnover rate of more than 20% for both small and large firms. The new-hire rate is higher at 29% for small firms and 31% for large firms.

Employee demographics for small and large e-commerce companies are also mostly similar, however, there are some important differences to note. The e-commerce industry as a whole is dominated by male employees, along with the broader technology sector. But there are marginally more females at larger e-commerce firms (23% vs. 21%). Larger e-commerce companies also have a slightly younger employee population with Millennials (born between 1981 and 1996) comprising 66% of their total workforce vs. 58% at smaller firms.

Next Steps

As e-commerce companies rapidly grow to meet consumer demand and face an increasing list of competitors, it’s important for these businesses to understand how to plan for workforce growth proactively — particularly in a tight labor market. For example, growing into a larger e-commerce business often means you need to hire more experienced product developers and engineers — positions that are in high demand outside of the e-commerce industry as well. As a result, you’ll need to examine how your current total rewards package stacks against your competitors for these hot jobs. Careful workforce planning early on will lay the groundwork to leverage and take advantage of high growth in this industry.

With that purpose in mind, it is very helpful to know how you stack up against your peers:

- Are you more top heavy than others?

- Is your workforce more clustered in certain job functions compared to your peers? If so, is there a good business reason for this?

- Does your geographic footprint take advantage of labor market opportunities outside of overheating areas such as the San Francisco Bay Area or Seattle?

- Are you losing population segments at higher rates than competitors?

- Is your span of control unusually high or low?

To speak with a member of our consulting group about how we’re helping e-commerce companies approach workforce planning and rewards, please write to [email protected].

Related Articles